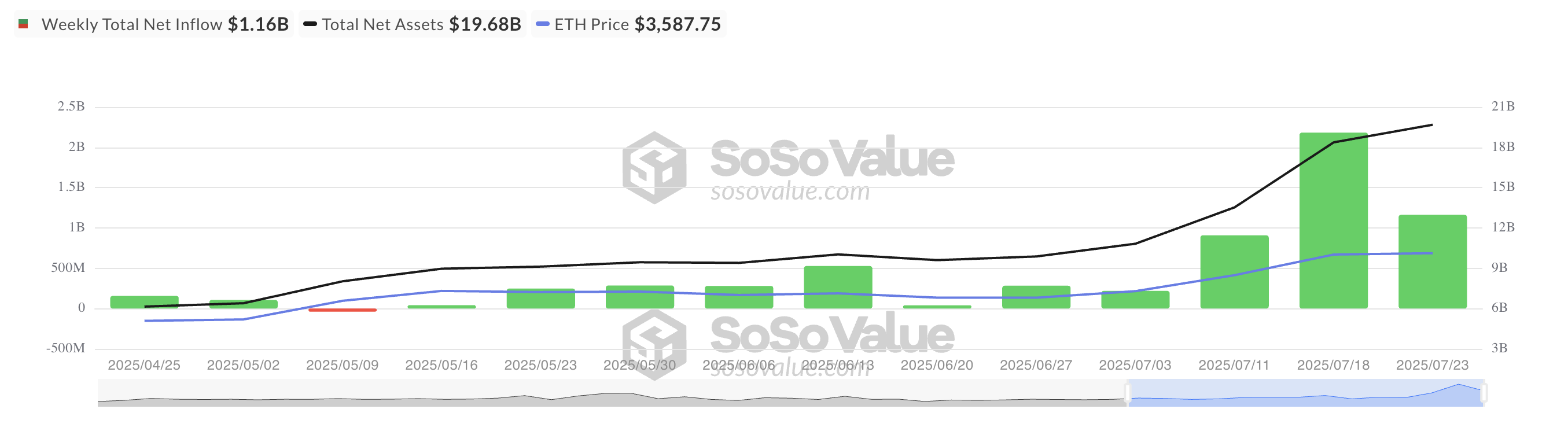

Ethereum (ETH) continues to attract institutional interest despite recent price rebounds. Over $1 billion has flowed into ETH investment funds this week alone. This underscores the growing institutional appetite for assets.

However, the price performance of the coin does not reflect this bullish investment activity. Despite the heavy inflow, ETH is primarily under pressure from increased profits by long-term holders (LTHS).

Ethereum inflows hit the mark of 11 consecutive weeks when prices fell below $3,600

According to SosoValue, the second-largest crypto by market capitalization is currently the 11th consecutive week of net inflows into ETH ETFs. This is a sharp contrast to Bitcoin (BTC). This has recently been witnessing a prominent net spill, as prices seem to shake up investors' trust.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya's daily crypto newsletter.

All Ethereum spot ETF net flow. Source: SosoValue

However, despite this strong wave of institutional support for ETH, the influx has not been converted into upward price momentum. On the contrary, ETH prices continued to fall, overwhelmed by a surge in profitable activities.

At the time of press, Altcoin will trade at $3,553, a 5% decrease from Monday. What triggers this dip?

Smart money is quietly heading towards the exit

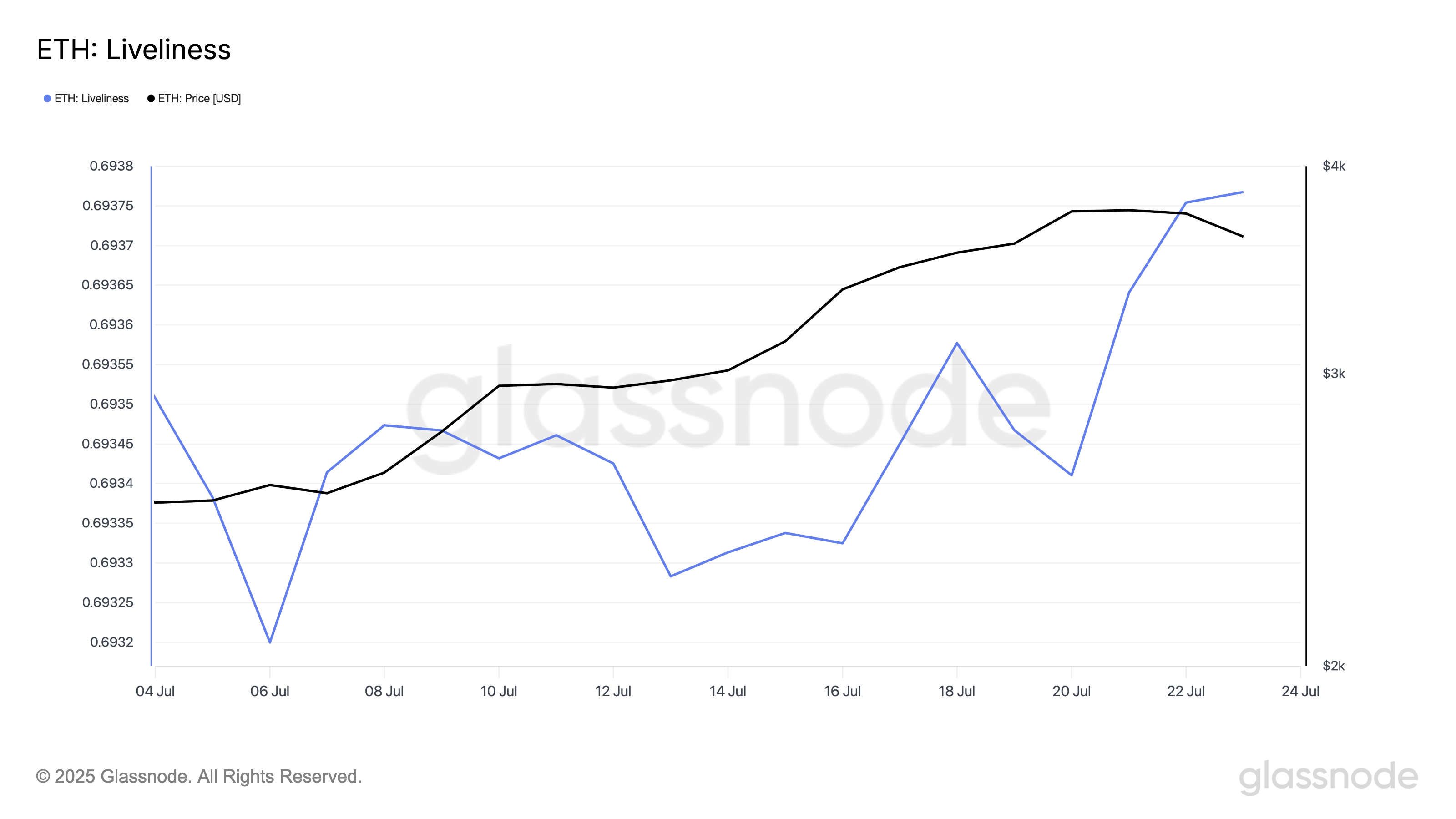

On-chain data shows the growing vibrancy of ETH. This means that the long-term holders (LTHS), which are usually the most resilient hand on the market, are increasingly selling coins. At press, this is 0.69.

The vibrancy of ETH. Source: GlassNode

Vitality measures the movement of long tokens by calculating the ratio of coin days to the total accumulated coin days. Once that falls, LTHS is choosing to move the assets off the exchange and hold them.

Conversely, this rise means that more dormant tokens are being moved or sold, signaling profits by long-term holders.

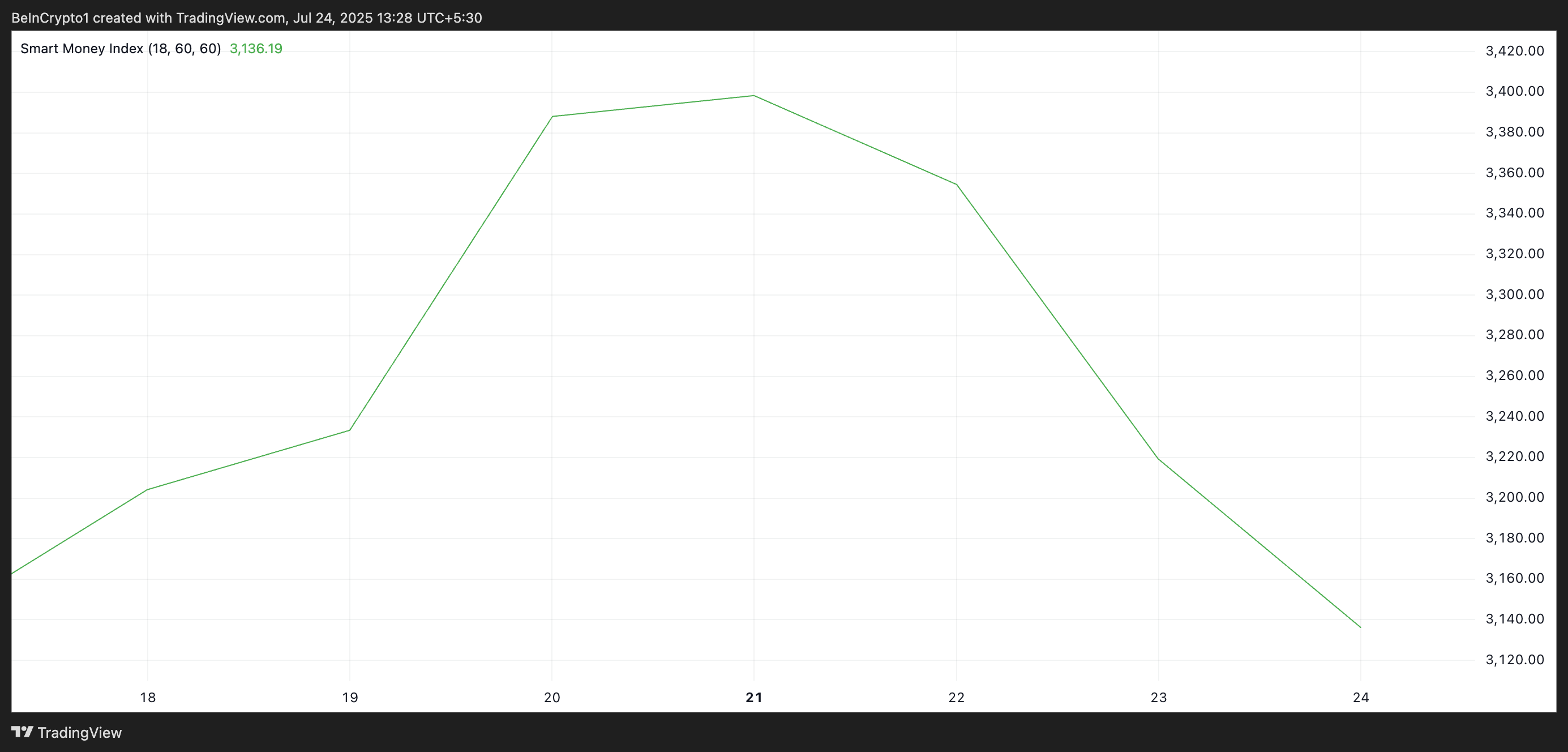

Additionally, the ETH/USD one-day chart confirms selling between major coin holders due to a decrease in ETH's Smart Money Index (SMI). Measurements from this indicator show that its value has fallen 7% since July 20th.

ETH SMI. Source: TradingView

Smart money refers to capital managed by institutional investors or experienced traders with a deeper understanding of market trends and timing. SMI tracks the behavior of these investors by analyzing price movements during the day.

Specifically, it measures sales in the morning (when retailers control it) and sales in the afternoon (when institutions are more active).

When the asset's SMI falls like this, Smart Money is offloading its location. In the case of ETH, this distribution appears to be driven by a desire to lock in profits from recent gatherings.

ETH faces a tug of war between smart money sellers and dip buyers

ETH's eyes fall below $3,524 if the main owner continues to sell. If this level breaks down, Altcoin can exchange hands for around $3,314. Not providing support at that point could lead to a deeper fix to $3,067.

ETH price analysis. Source: TradingView

However, this bearish view is ineffective when buy-side pressure increases. In that scenario, ETH prices could revisit the recent cycle peak at $3,859, and attempt to breakout beyond that level.