Ethereum forms a bullish cup and handle pattern over the 200-day EMA to trade around $2,509. Will ETH exceed $3,000?

Ethereum continues to consolidate within its scope, maintaining its 200-day EMA advantage at $2,457. As ETH integration continues, bullish cup and handle patterns appear on daily charts. Will Ethereum break out of the pattern for an extended rally?

Ethereum price analysis

On the daily chart, Ethereum shows a round bottom reversal between February and May, with a Fibonacci level of 61.80% and an aligned neckline of $2,712. Currently, Ethereum is moving sideways just below this neckline, supporting a 200-day EMA for $2,457.

Lateral movement and U-shaped inversion complete the round bottom pattern of your daily chart. Furthermore, this reversal caused bullish crossovers between the 50- and 100-day EMA lines, indicating a potential short-term trend reversal, increasing the likelihood of a breakout.

Currently, Ethereum is trading at $2,509 near the lower limit of the pattern and the 200-day EMA, but the RSI line continues to decline. This indicates a weaker momentum and a hidden bearish divergence, suggesting a possible breakdown.

In such a scenario, immediate support is $2,386 at the 50% Fibonacci level, followed by $2,098 at the 38.20% level. However, as the broader market recovers, bullish breakouts from the patterns are possible. This could trigger an uptrend towards a Fibonacci level of 78.60% for $3,255.

Optimistically, a confirmed breakout could extend the rally to a 100% Fibonacci level for $4,108..

The derivatives market remains full of hope

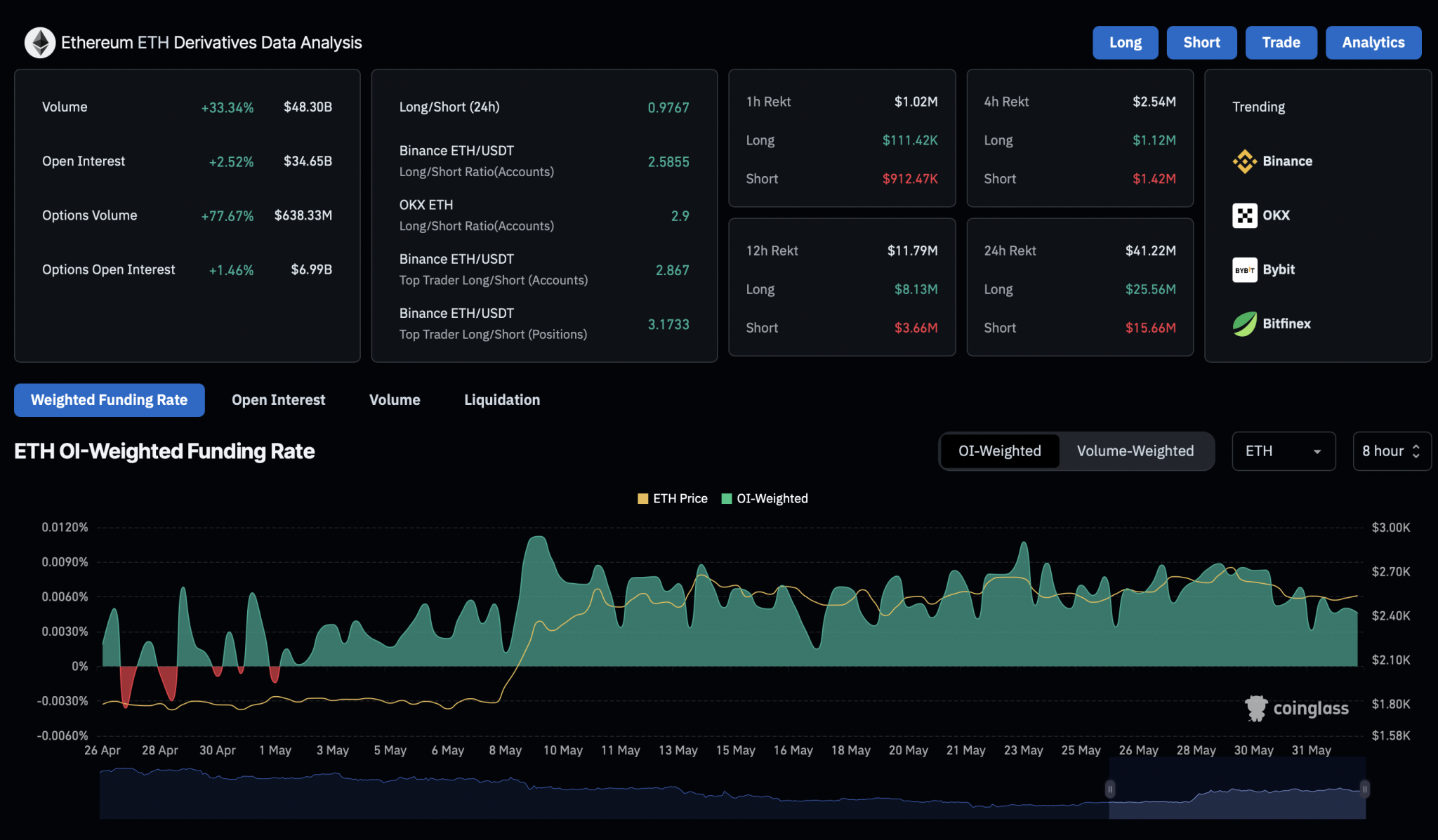

Despite the hidden bearish venting suggestive of a potential pullback for RSI, the bullish chart pattern has led to an increase in optimism in the derivatives market. Ethereum's open interest increased by 2.52% to $34.65 billion, with funding rates rising slightly.

Ethereum Derivatives

This suggests an increase in bullish activity in the market. However, the long liquidation over the past 24 hours has risen to $25 million, while the short liquidation remains low at $15.66 million.

Currently, the long-term ratio over the past 24 hours is 0.9767, indicating a slight bearish bias in the market.