Ethereum price iAgain at an important intersection. After several weeks of consolidation, ETH prices are displayed Signs of new momentum. Traders and investors are currently watching closely as prices above key resistance levels suggest a potential breakout. With Bitcoin steady and altcoins gaining traction, this week's Ethereum price action can define the rest of June. But is it really over $3,000 or is this another bull trap?

Ethereum price forecast: What's going on with your daily charts?

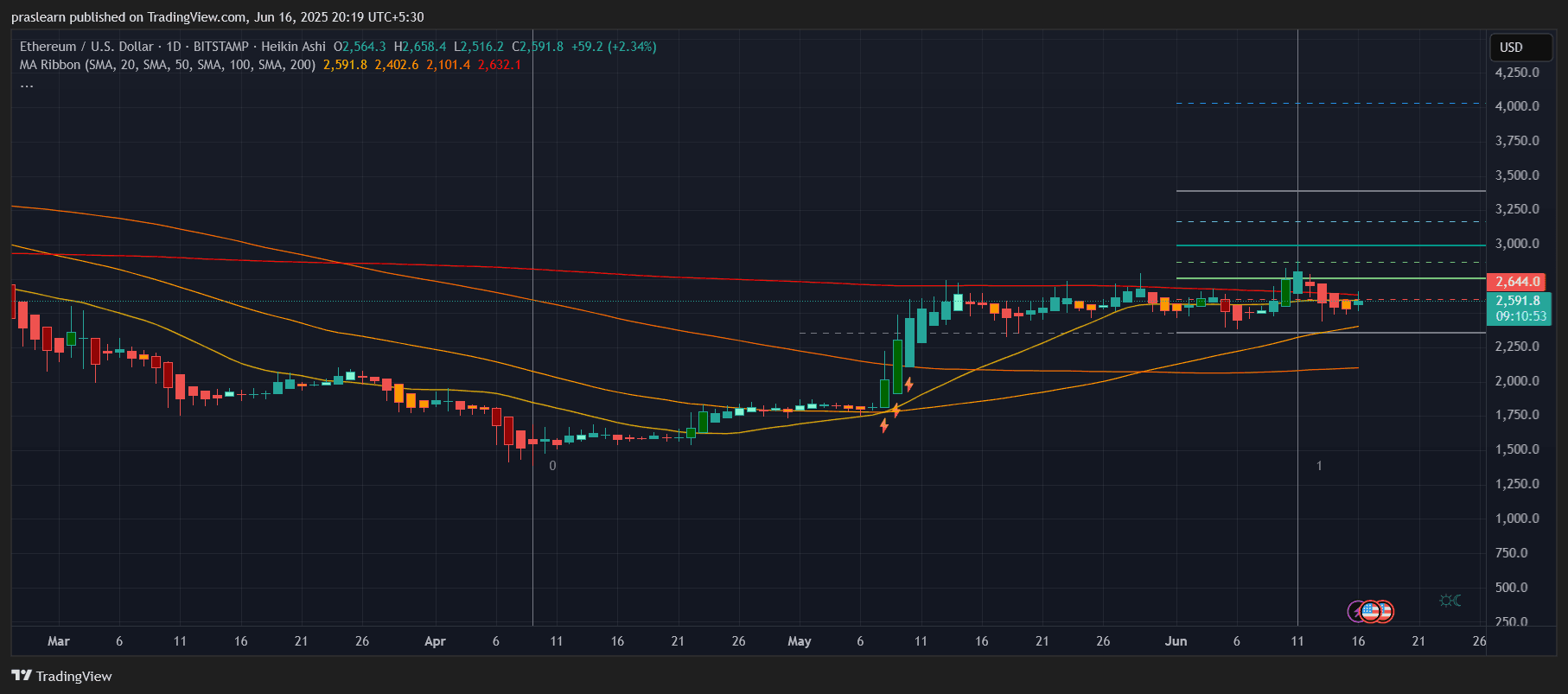

ETH/USD 1-Day Chart – TradingView

Ethereum (ETH) prices have shown resilience after bounced back from their lows in May and are currently trading around $2,591. The daily charts observe healthy recovery trends, but ETH still wrestling with resistance near the 200-day SMA for $2,632. The recent layer of hikin reed candles is green, and again gains body length.

Daily 20 SMAs ($2,591) are currently above 50 SMAs ($2,402), often showing a mid-term bullish crossover. This is very important as it indicates that Ethereum is no longer a bear compression pattern. The consolidation that lasted most of June appears to have ended, with ETH retaining key support for over $2,500 and attempting a breakout.

Hourly charts suggest short-term surges

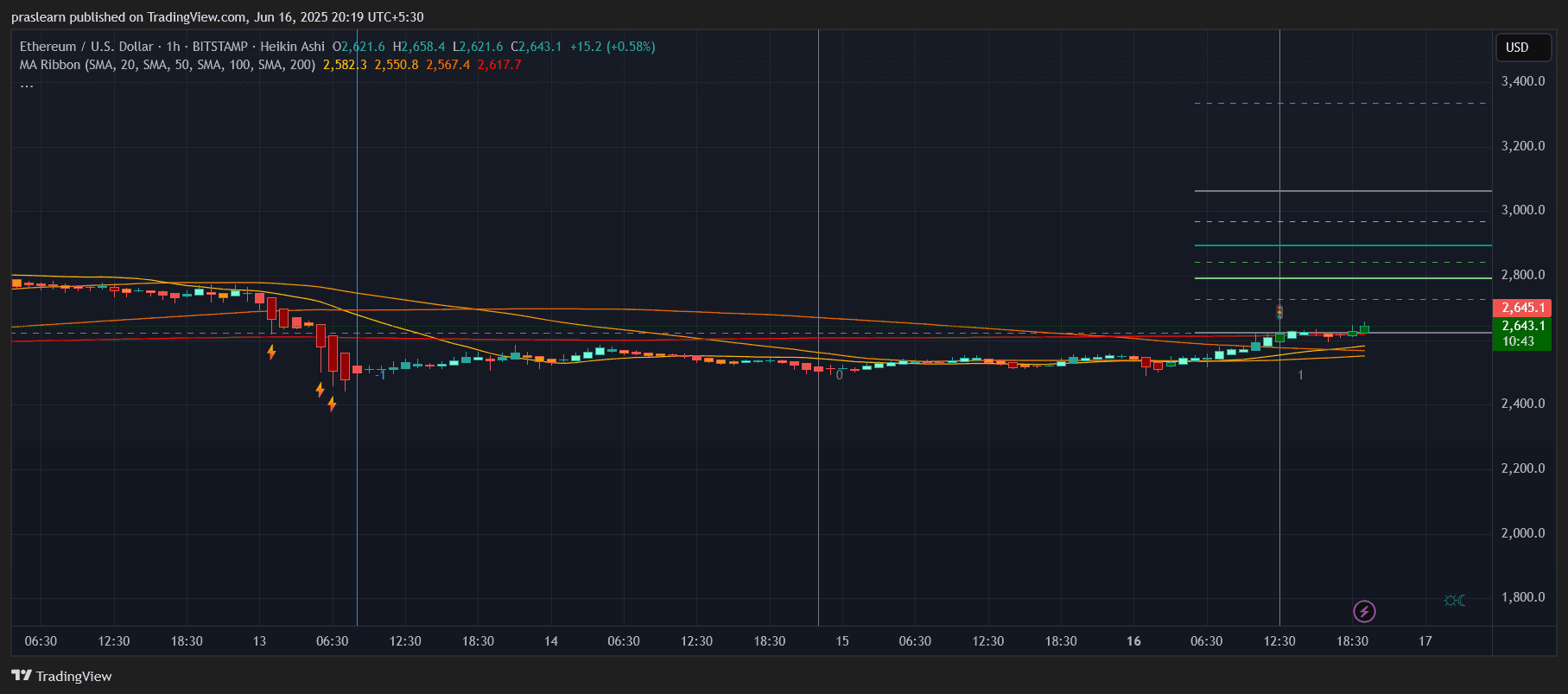

ETH/USD 1 hour chart – TradingView

Zooming into the hourly chart, ETH prices have recently broken on top of tight MA ribbon clusters of 20, 50, 100, and 200 SMAs. They promised a range of $2,550-$2,580 and are now serving as strong support. Hourly hikin ash candles show a consistent green candle, suggesting that daytime momentum is clearly above.

Fibonacci retracements and expansion levels, published on the hourly chart, show the following key resistance zones at $2,780, $2,910 and $3,080. Ethereum has already cleared the 0.236 retracement zone and is about to close it above the 0.382 level. Clean breaks over $2,650 and hourly candles could quickly send ETH to $2,780.

How strong is the current uptrend?

Moving Average Ribbon Breakout is a classic setup. When you move around with Ethereum prices 20-200 SMA bands, you often mark trend shifts. Applying the Fibonacci extension to May lows ($2,050) to June highs ($3,140) will bring a target level of 1.618 nearby $3,850.

Calculate the chances of breakouts in ETH:

If the ETH price exceeds $2,600 and collects up to the 0.618 level (~$2,910), then this is:

($2,910-$2,600)/$2,600×100 = 11.92% upside.

If you target 1.0 Fibonacci extension level for $3,140:

($3,140-$2,600)/$2,600×100 = 20.77% upside.

This makes Ethereum's risk compensation setup very appealing to swing traders with a holding of $2,550.

Can Ethereum hit $3,000 again?

Yes – but only if it's maintained daily, it's over $2,620 this week. That level serves as a mini W-shaped double bottom neckline for hourly and 4H charts. If the ETH price clears $2,780 in resistance (marked at the 0.5 Fibonacci level), the next rally could target $3,000 psychologically and structurally $3,140.

What is the worst case scenario?

If Ethereum prices are unable to hold $2,550 in support, you could potentially retest the $2,400 zone. This can disable breakout setup and short-term emotions can suck bearish again. However, a strong confluence of the moving average should serve as a strong demand zone of between $2,567 and $2,582.

Ethereum Price Prediction: What's next?

- Short term (1-3 days): ETH prices may retest $2,780 if $2,620 is held

- Medium period (7-14 days): $3,000 is the next powerful magnet

- If momentum continues: expansion targets are close to $3,140-3,850

Ethereum prices are flashing early breakout signals both in hourly and daily time frames. If it rides beyond the $2,650 range and passes the local resistance zone, you can see a strong rally towards the $3,000 psychological barrier. Keep an eye on the volume and make sure daily closures go above $2,620 to see bullish continuation.

$eth, $ethereum