Bitcoin price is at a decision point after a quiet pullback. Since its peak on January 5th, BTC has fallen, but a major crash was avoided. Bitcoin is down about 4.5% year-on-year, and its annual performance remains slightly negative.

This little red number is more important than it looks. A narrow price window currently separates Bitcoin from a rare historical signal that last appeared in 2020. Whether Bitcoin reverses or fails could determine the next trend.

4.5% Bitcoin price change may reflect a rare pattern in 2020

Recent historical analysis has revealed an unusual setting. When Bitcoin's one-year price movement turns negative and then turns positive again, it often signals a major trend change. This unusual move surfaced in July 2020 and was followed by a strong bullish phase.

Something unusual is happening with Bitcoin!

A negative one-year percentage change has historically been associated with a bear market, except in July 2020, when it briefly turned negative and was quickly followed by a strong bull market.

Now, the current setup… pic.twitter.com/3YdmKj0C7L

— Alphractal (@Alphractal) January 10, 2026

Bitcoin is currently hovering just below that tipping point. A fluctuation of about 4.5% would turn the annual change green and repeat that historical situation.

The structure of the graph supports why this is important. Bitcoin is trading within the handle of the cup-and-handle pattern, a bullish formation where price pauses after a rounded recovery before attempting a breakout.

Hold a breakout pattern: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

It would be interesting to see if the breakout distance measurements for this pattern (above the neckline) closely match the same 4-5% zone.

95% drop in EMA support and selling pressure strengthens the position

Short-term trend movements are reinforcing the bullish outlook.

Exponential moving averages (EMAs) give more weight to recent prices and are useful for tracking the direction of short-term trends. Bitcoin recently regained its 20-day EMA and is trading above it. The last time BTC regained these levels was in early January, when the price rose nearly 7% within a few days.

The loss of the 20-day EMA in mid-December resulted in a 6.6% decline, showing how reactive prices were around this level. For now, sustaining above that will maintain upside momentum.

EMA holds BTC line: TradingView

The next hurdle is the 50-day EMA. Bitcoin lost this level on January 12th and corrected shortly thereafter. A clean recovery would indicate a stronger trend recovery and would be consistent with the cup and handle breakout structure.

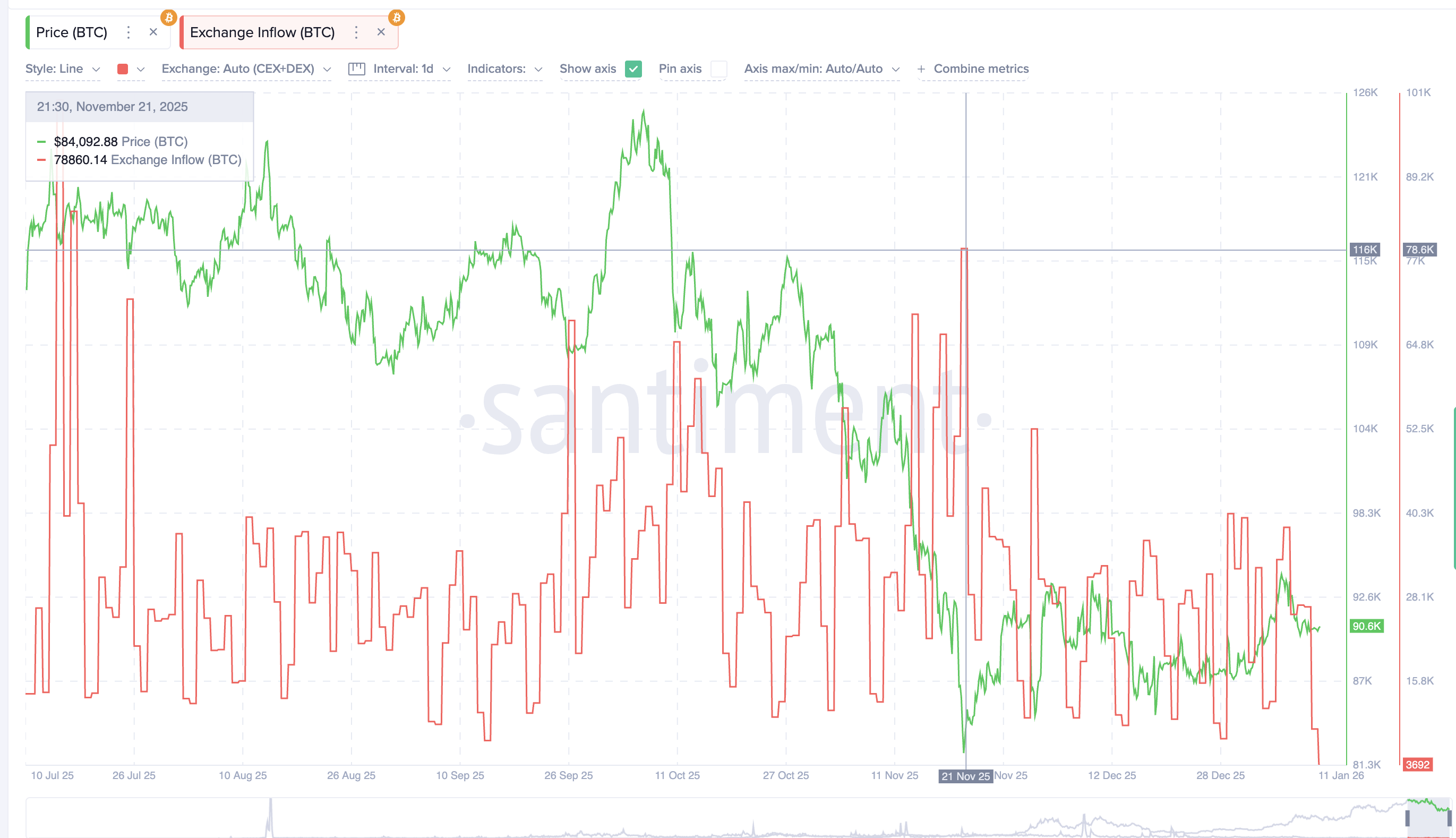

On-chain data carries more weight. Inflows to exchanges, which track the movement of coins into exchanges and often indicate intent to sell, have fallen to a six-month low. The daily inflow amount has decreased from about 78,600 BTC on November 21st to about 3,700 BTC now, a decrease of more than 95%.

Possibility of decline Selling pressure: Santimento

This large drop suggests that selling pressure has dissipated. Fewer coins are sent to exchanges, reducing the supply that can be sold to Rally.

Derivatives pressure and key Bitcoin price levels will determine next leg

Leveraging positioning adds another layer.

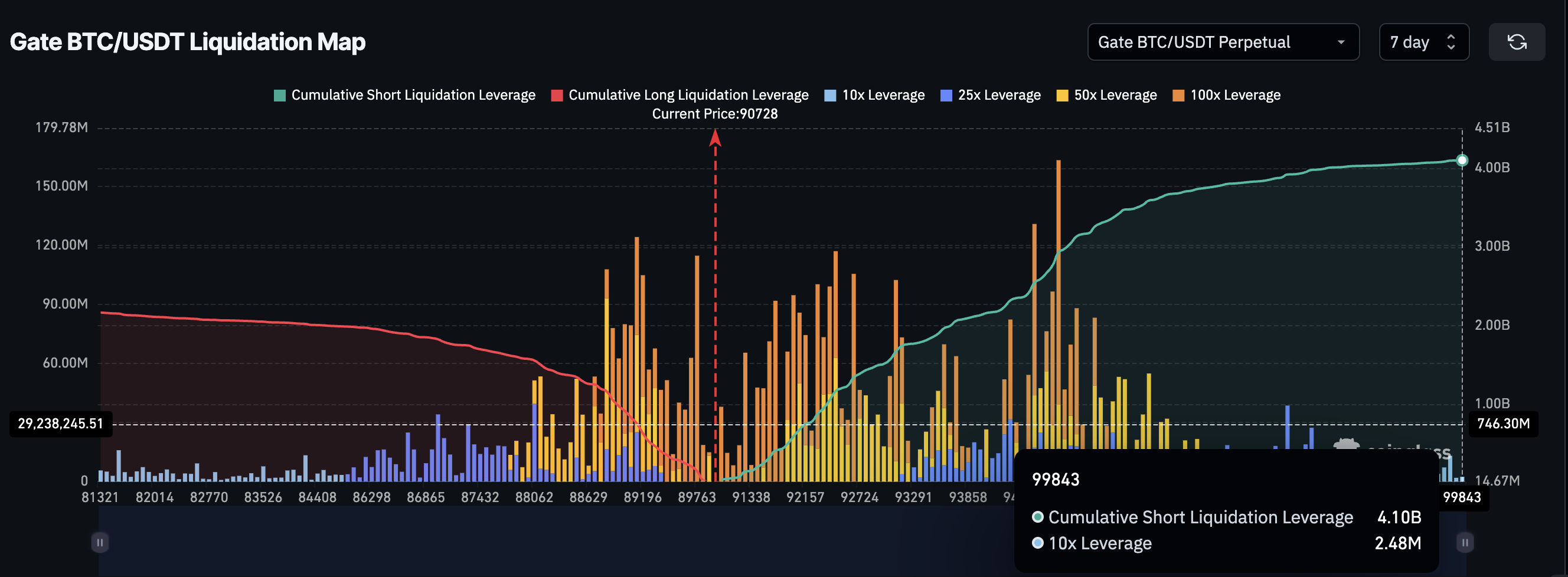

Cumulative short liquidation leverage over the next seven days will be approximately $4.1 billion and long liquidation exposure will be approximately $2.17 billion. This makes short exposures about 89% more expensive than long exposures.

Liquidation Map: Coin Glass

Dense short positioning creates fuel. If BTC price starts to rise, forced short covering could automatically add buying pressure. Bitcoin has repeatedly moved against leverage bias over the past year, making this imbalance more pronounced than bearish.

All this converges to a clear price level.

A daily close above $94,880 would complete the cup-and-handle breakout, consistent with a 4.5% annual reversal. From there, upside targets are around $99,810, followed by $106,340 based on Fibonacci extension and cup breakout predictions.

Bitcoin Price Analysis: TradingView

On the downside, $89,230 provides the first significant support. A loss of this level would expose $86,650 and invalidate the bullish structure.

For now, Bitcoin price is in a narrow corridor.

Selling pressure is at a six-month low, short-term trend support is holding, and a rare historic signal is just 4.5% away. Whether Bitcoin reaches that point may determine what happens next.

The post Bitcoin Bull Market Will Begin with a 4.5% Rise?History and Charts Final Align appeared first on BeInCrypto.