Bitcoin is showing bearish momentum, with futures flows favoring sellers and technical indicators pointing to the possibility of lower volatility.

Bitcoin's current price change is $91,524, reflecting an increase of 0.3% over the past 24 hours. However, recent price trends have been volatile, hovering near seven-month lows.

This follows a brief decline in BTC. less than $90,000a fraction of the price since April. Bitcoin briefly recovered towards the $94,000 level, but struggled to maintain its gains as market sentiment remained cautious.

Bitcoin is down 11.3% in the past 7 days and 10.1% in the past 14 days, showing an overall bearish trend.

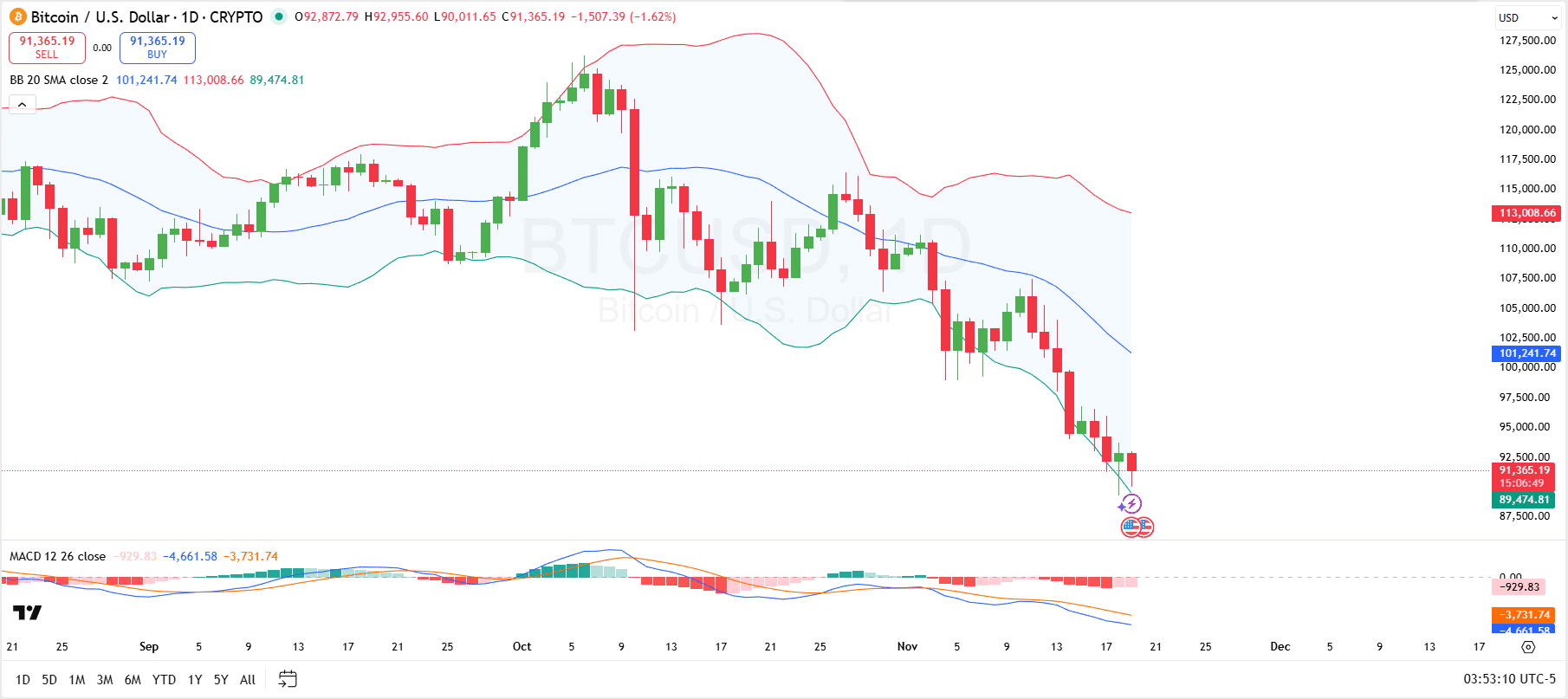

Bitcoin technical analysis

On the technical side, Bitcoin is currently showing strong bearish signals as shown by several key technical indicators, but the situation could reverse in the near future. The price is trading just above the lower Bollinger Band at $89,474.81, which usually signals an oversold situation.

Bitcoin

Prices near the lower band often signal further declines unless the market finds support and reverses course. On the positive side, the Bollinger Bands have widened in recent trading sessions, indicating increased volatility, but this could also signal an impending contraction as volatility decreases.

This could push Bitcoin towards the middle band and act as an immediate resistance at $101,241, potentially benefiting the bulls as well. Further resistance exists above the Bollinger Band near $113,008.

Meanwhile, the convergence divergence of the moving averages further supports the bearish sentiment. The MACD line is below the signal line, clearly indicating downward momentum. Additionally, the negative histogram confirms that selling pressure remains strong and that the overall trend remains heavily biased to the downside.

A potential reversal could occur if the price recovers towards the central Bollinger Band and the MACD shows signs of a bullish crossover.

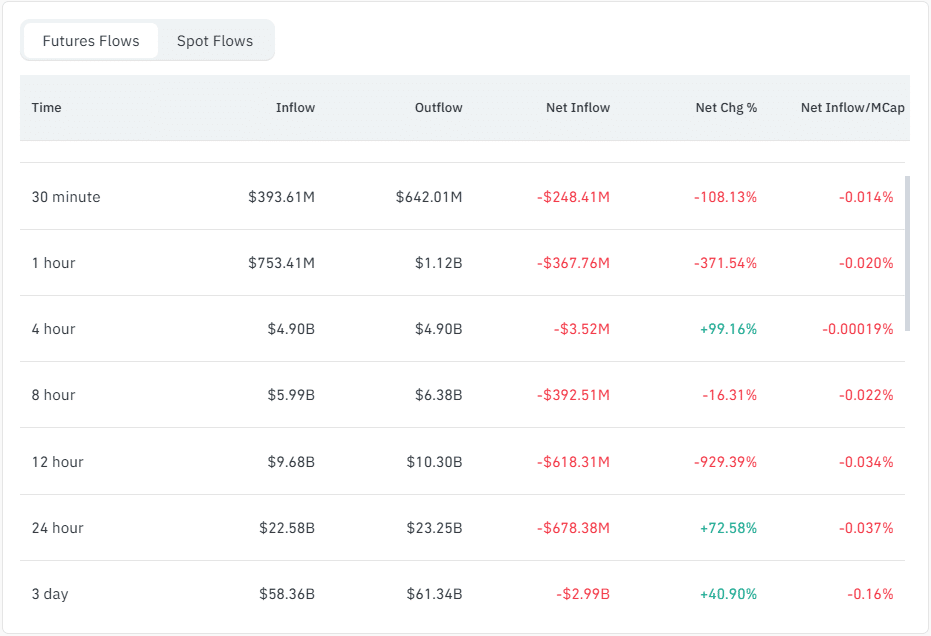

Bitcoin futures flow data

Futures are flowing elsewhere. data Data extracted from Coinglass reveals selling pressure in Bitcoin trading, with clear bearish sentiment across multiple time frames. In the 4- and 8-hour intervals, net inflows are either slightly negative or slightly positive, reflecting a continued trend of traders exiting positions.

The 4-hour net inflow is negative (-$3.52 million), but the 8-hour also has a negative net inflow of -$392.51 million.

If you look at long-term data such as 12-hour and 24-hour flows, the negative trend is increasing. The 12-hour net flow shows a sharp outflow with a dramatic change of -929.39%, highlighting increasing selling pressure.

The 24-hour data also reflected net outflows of -$678.38 million, suggesting that overall market sentiment remains bearish as investors find safety amid market uncertainty. This trend suggests that downward pressure on Bitcoin price may continue in the short term.