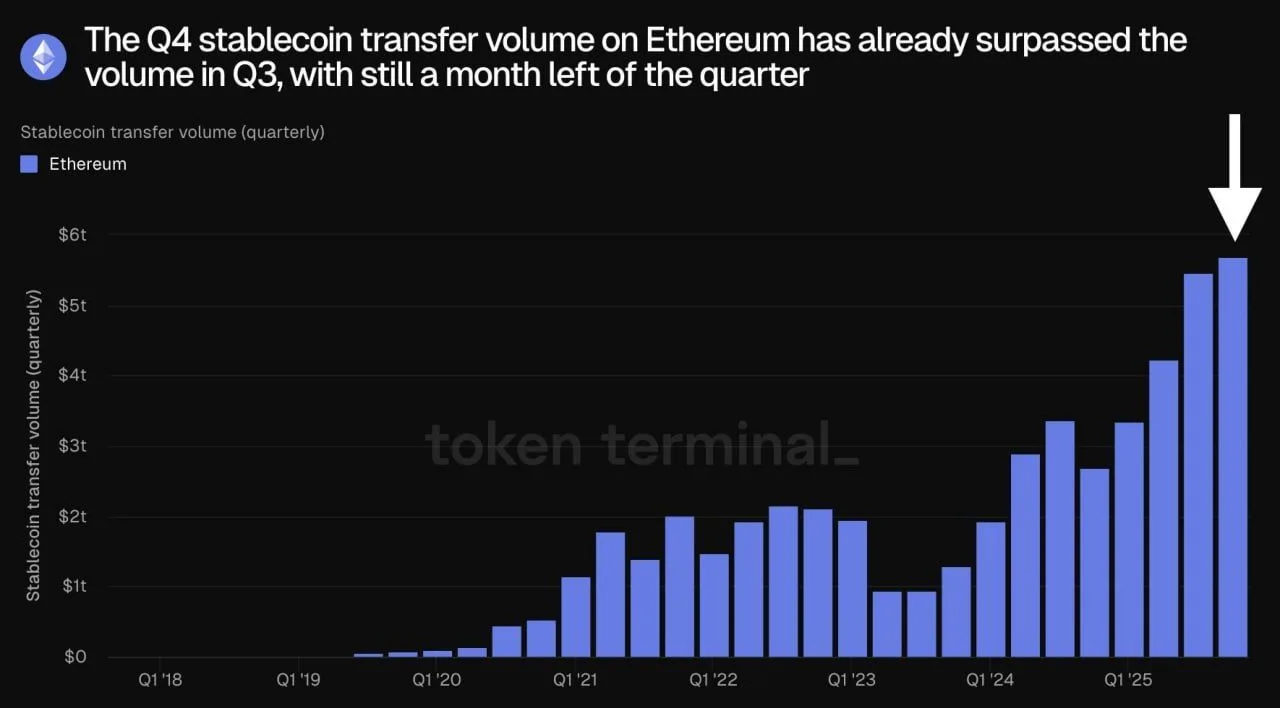

Ethereum has shown two major signs this quarter: record stablecoin payment flows and a new long-term accumulation pattern highlighted by market analysts. According to the latest data from Token Terminal, stablecoin transfers in the fourth quarter reached nearly $6 trillion, already exceeding the previous quarter's total with only a few weeks left.

At the same time, chart analysts say Ethereum's multi-year structure is moving into a Wyckoff accumulation phase, reflecting quiet positioning behind the scenes as the market resets after the 2022-2023 selloff.

Ethereum stablecoin trading volume approaches $6 trillion in Q4

Ethereum is on pace to process around $6 trillion in stablecoin transfers during the fourth quarter, according to new data from Token Terminal. This chart shows that Q4 activity is already above Q3 levels, even though the quarter is not over yet. This marks one of the most active periods for Ethereum on-chain payments, as demand for stablecoin transfers continues to accelerate across DeFi and exchange infrastructure.

Ethereum stablecoin transfer volume (quarterly). sauce: token terminal

This number also means that Ethereum exceeds the most recent quarterly trading volumes reported by Visa and Mastercard. Although the networks measure traditional payment activity and Ethereum tracks on-chain transfer volume, the difference in size this quarter is still notable. This highlights how much value is currently moving through blockchain rails as stablecoins become the preferred payment tool for transactions, remittances, and institutional flows.

The surge in activity strengthens Ethereum's position as the leading payment environment for stablecoins. USDT, USDCand other dollar-pegged tokens accounted for the bulk of the volume, driven by increased usage across decentralized exchanges, lending pools, and cross-chain bridges. Although there is still a month left in the quarter, analysts expect the final numbers for the fourth quarter to be the Ethereum stablecoin's largest trading volume ever.

Analyst maps Ethereum to new Wyckoff accumulation phase

Crypto GEMs claims that Ethereum has entered a new accumulation zone under the Wyckoff market cycle framework, based on a long-term price chart that labels previous price appreciation, distribution, price decline, and accumulation phases. The current range follows the decline in 2022-2023, which analysts are treating as the last pullback before the underlying trend resets.

Ethereum Wyckoff cycle phases. sauce: Crypto GEM/TradingView

According to this analysis, the flat structure after 2023 reflects an earlier period when large companies were quietly positioning themselves ahead of a strong breakthrough. Cryptocurrency GEM says that past cycles on the chart indicate that a similar accumulation block existed ahead of a strong markup leg and that new advances could eventually bring about Ethereum Toward $20,000 territory by 2026.

The post notes that sentiment remains divided, with skeptical traders viewing the range as depleted, while more optimistic holders see it as an opportunity to increase exposure. The Wyckoff markup phase remains dependent on widespread liquidity, macro conditions, and sustained demand for the Ethereum network and applications.