As the XRP supply shock theory continues to gain traction, prominent commentators argue that on-chain data does not support the claim.

Recently, several reports have revealed that the amount of XRP held on exchanges is decreasing. Proponents of the supply shock theory, including Zack Rector, amplify this trend, pointing specifically to Binance's declining XRP balances as evidence.

They claim that as foreign exchange reserves dwindle, XRP's liquidity on major trading platforms could dry up, leading to a spike in prices.

Exchange still holds 15 billion XRP

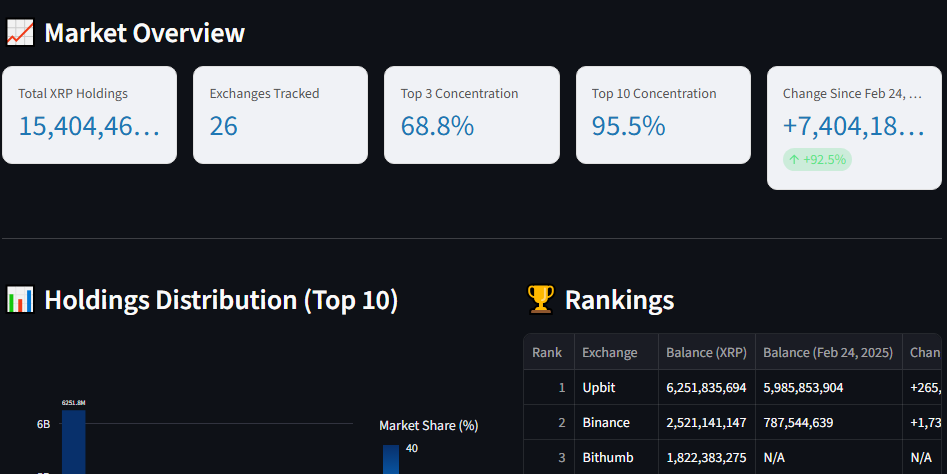

Meanwhile, as speculation intensifies, community members shared data from platforms that track XRP exchange balances. The latest update shows that 15,401,504,547 XRP (15.4 billion) are still held on 26 exchanges.

According to the data, South Korean exchange Upbit holds the largest share, with 6.25 billion XRP distributed across 13 wallets. Binance holds 2.52 billion XRP in 21 wallets, followed by Bithumb in third place with 1.82 billion XRP in 9 wallets. Overall, the other exchanges in the ranking hold between hundreds of millions and billions of XRP in total.

XRP exchange balance

Experts criticize supply shock theory

Reacting to the data, legal expert Bill Morgan ridiculed the supply shock narrative and argued that current figures do not support it. His commentary highlights some supply realities that undermine claims of impending supply shortages.

Specifically, Morgan pointed out that the 15.4 billion XRP held on 26 exchanges is only 15% of the token's total supply of 100 billion. He also pointed out that this figure accounts for approximately 25% of the circulating supply of 60.67 billion XRP.

His argument suggests that in a genuine supply shock scenario, there should be a shortage of liquid tokens that can be traded on exchanges. In return, over 15 billion XRP will remain easily accessible, providing deep liquidity for both buyers and sellers.

ETFs hold less than 1% of supply

Meanwhile, Morgan also addressed the role of the XRP ETF, which some investors believe could cause a supply shock as they acquire more tokens.

According to his assessment, XRP held in spot ETFs accounts for just under 1% of the total supply. This is too small to meaningfully limit distribution or create sustained shortages.

For context, according to SoSoValue data, the Spot XRP ETF has a net asset value of $1.27 billion, which equates to just 679.14 million tokens, or 0.67% of the total supply. Unlike Bitcoin, where ETFs have absorbed a significant portion of the BTC supply, the XRP ETF currently has only a negligible impact on overall availability.

Notably, Mr. Morgan underlined his position by openly laughing at the “supply shock” theory, effectively ridiculing the idea that it could cause meaningful price increases. Earlier this week, prominent XRPL dUNL validator Vet expressed a similar view, dismissing the supply shock narrative as ineffective.

He emphasized that the exchange still holds huge XRP reserves, adding that traders can quickly replenish their exchange balances by sending tokens to the trading platform within seconds whenever the price changes.